Buddies or family. You could borrow dollars from friends and family to address unanticipated charges, but be sure you shell out them back again or you could possibly damage your connection.

May possibly overdraft your account. Cash apps deduct money from a checking account to repay your cash advance, which could lead to an overdraft in the event you’re not thorough.

You may obtain way more with Dave than you’ll locate with all kinds of other money-borrowing apps. Borrowers can qualify for as many as $five hundred Along with the ExtraCash feature that deposits money right on to the Dave Debit Mastercard.

Varo demands you to have a bank account with them, which implies you'll have access to your cash advance financial loans Practically instantaneously Once you use. Without the need of prior enrollment or setup, EarnIn or MoneyLion are the fastest cash advance apps, featuring set up and funding exactly the same day.

We also calculated an efficient APR for each lender, which factored in expenses like subscription expenses and immediate cash transfer fees, but we didn't involve instructed tip amounts.

Drop by web-site Read critique EarnIn is usually a no cost application that permits you to borrow $150 on a daily basis — or even more by having an EarnIn Card — as many as $750 of the money you've got gained Every single shell out interval, without any month to month subscription cost.

Dave is often a banking app that provides cash advances of as many as $five hundred each individual fork out interval. For Undisclosed per month, Dave transfers money in your banking account inside three company times.

Dave is usually a best option for users hunting for a cash advance application that mixes instant cash accessibility with a whole suite of on the net banking attributes.

Klover’s cash advance (identified as a ‘Enhance’) does have stricter requirements so it will not be the ideal suit if you’re a freelancer or gig worker with numerous earnings streams.

Response several rapid issues, and PockBox will instantly fetch loan offers from nearly 50 lenders, so you can find the give that actually works finest in your case.

This element is especially handy in the event you routinely find yourself small on cash and be worried about overdrawing your account. Albert routinely addresses the gap at no extra demand, therefore you won’t turn out paying NSF expenses.

A cash advance app could be a safer possibility. Alternatively, you could possibly ask a pal or member of the family to lend you the money. Just make sure you the two recognize the financial loan conditions and have every thing in writing if you decide to go website this route.

It’s normally the case you have to pay a lot more for An immediate transfer, but that’s a suitable tradeoff when obtaining your money in two to 3 business times simply just won’t Slash it.

Taking a paycheck advance is simply a stopgap evaluate. It doesn’t make your limited paycheck stretch any more this thirty day period than it did past month.

Rider Strong Then & Now!

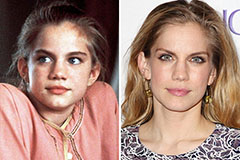

Rider Strong Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!